In his latest column, Tom Waterhouse of Waterhouse VC analyzes how gambling monopolies operate in regulated markets.

A coffee for $10? It’s too much, but when you’re the only coffee shop in town, you have pricing power – and people love coffee.

Therefore, there are often monopolies in regulated betting markets. They have significant advantages as they offer exclusive products, have widely trusted brands and have a strong relationship with the government and industry. However, a lack of competition and a limited product offering can sometimes result in a sub-optimal outcome for consumers.

Below are examples of some monopolies.

Happy valley

Founded in 1884, the HKJC has a rich history rooted in horse racing. The club’s inaugural races were held at Happy Valley. The club actively contributes to charitable causes, becoming a hallmark of its identity and position in Hong Kong’s economic landscape.

In 1959, regulatory changes through the Betting Duty Ordinance expanded the HKJC’s scope to allow off-course betting.

The HKJC imposes a 50% tax on its gross margin in football, while the tax in racing is up to 75%. In the 2022-23 fiscal year, the HKJC returned $4.6 billion to the community. This included $3.7 billion donated to the government in the form of duties, profit taxes and lottery fund contributions, as well as $0.9 billion in donations to charities.

B2Bs and monopolies

At Waterhouse VC we focus on B2B providers that offer an important or innovative service to betting operators. Almost every betting operator needs odds pricing, trading and risk management, player account management (including KYC/AML compliance), customer loyalty and marketing services.

Similar to other operators, monopolies benefit significantly from technological advances in the industry by closely monitoring product offering trends and integrating innovative B2B products. There is a great opportunity for B2B providers to integrate with monopolies. For example, Voxbet – one of our portfolio companies – has had PMU as a customer for seven years.

If monopolies have a modern technology stack and the ability to develop a comprehensive product offering, they could thereby have the technological capability, product offering and great customer experience required to leverage their already well-known brand outside of their domestic jurisdiction expand and operate effectively in a more competitive environment regulated markets.

Geographic expansion would also allow them to increase their tax contributions and charitable activities in their home country.

By transferring their domestic experience, product offering, and technology stack to other markets, monopolies could adopt Flutter’s global strategy. Flutter developed its expertise in the UK through Paddy Power before expanding to Australia (Sportsbet), the US (FanDuel) and globally (local heroes including Sisal and MaxBet).

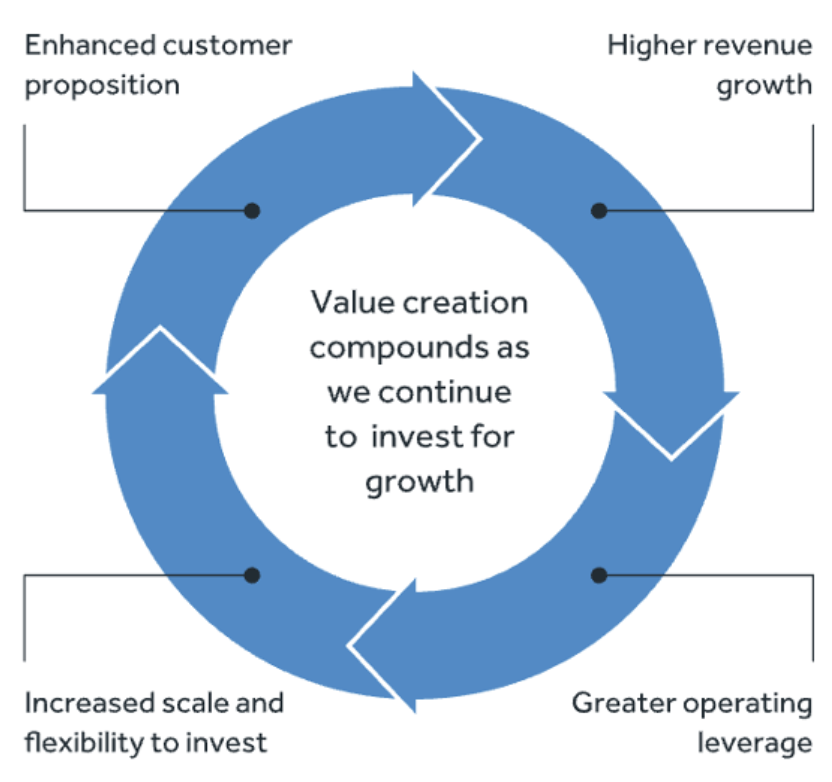

The company has built market-leading global betting businesses by leveraging its expertise and resources in product development, customer insights and data analytics. They have effectively exploited operational leverage, resulting in a “flywheel” effect.

Bleeding to unregulated operators

On September 5, following its annual general meeting, the HKJC specifically highlighted the leakage caused by the shift in betting volumes to unregulated operators.

“In the digital age, the club faces significant competition from illegal bookmakers who do not pay taxes and from foreign sports betting bookmakers who operate under very low tax regimes,” it said. “Illegal and foreign betting operators already make profits of over HK$15 billion per year from customers in Hong Kong.

“If the betting tax rates increase, the club would have to expect a significant loss of income and would be less competitive in terms of prices. This would mean the club would not be able to invest in its future.”

There is a loss of tax revenue in all regulated betting markets. In the United States, for example, it is estimated that unregulated operators attract a total of $510.9 billion in annual bets from Americans. This results in a significant loss of $44.2 billion in gambling revenue for the regulated betting industry and a loss of $13.3 billion in tax revenue for state governments (“Calculating Illegal and Unregulated Gambling Markets in the United States.” – American Gaming Association, 2022).

Closing product gaps to build monopolies

Relying solely on their monopoly power is not an optimal strategy for monopolies, especially in the context of increasingly accessible unregulated betting. Unregulated betting will force monopolies to engage in at least some degree of competition and they must provide an attractive product offering and customer experience. As regulated monopolies face ongoing pressure from unregulated operators, they must continually innovate to retain and attract customers.

In markets where some betting products are banned – such as iGaming and non-football sports in Hong Kong; or igaming and in-play betting in Australia – the introduction of a monopoly license covering product gaps could significantly reduce losses to unregulated operators while increasing taxation and charitable donations. This would also protect bettors, as unregulated markets generally offer a lower level of consumer protection.

When a monopoly operator is unable to offer a full range of betting products within its national jurisdiction – including pre-match sports, in-play sports, racing, igaming, lottery and bingo – unregulated operators take advantage of the opportunity to attract customers and their customers to further increase their own “flywheel”.

In this scenario, monopolies do not maximize their potential domestically – let alone internationally.

For large investors interested in following news and trends in the betting and gaming industry, please follow Waterhouse VC updates on Twitter (@waterhousevc) or via our website at WaterhouseVC.com.